UK Private Rental Prices Rise By 6.7 Percent

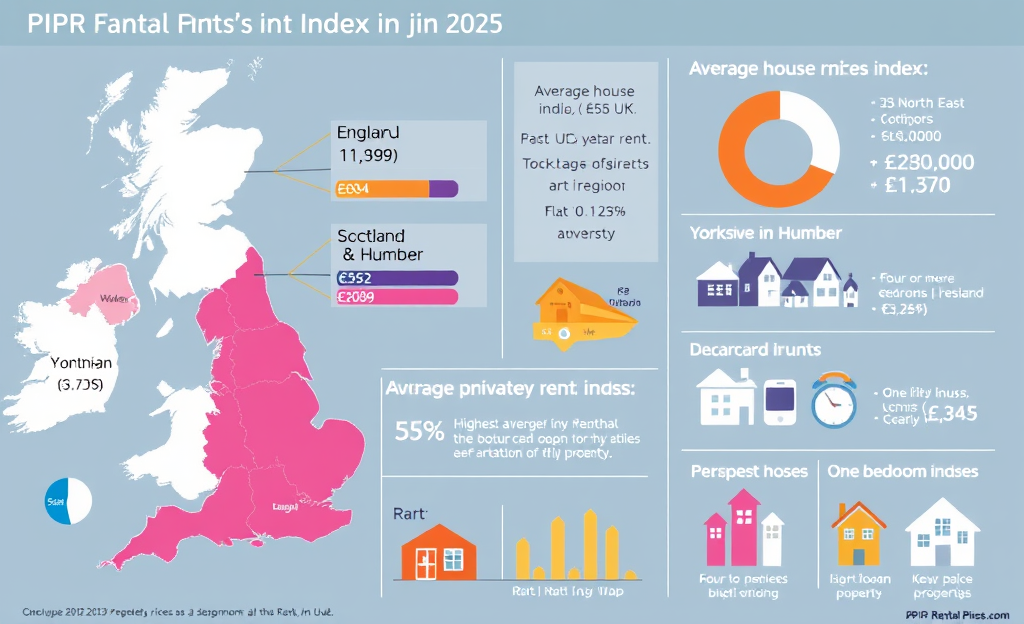

Private Rental prices in the UK have seen notable fluctuations, with recent data highlighting a 6.7% increase in average rents by June 2025. This article will delve into the regional variations in rental prices across England, Wales, Scotland, and Northern Ireland, while also examining the trends in house prices.

Understanding these dynamics is crucial for tenants, landlords, and potential homeowners navigating the current housing market landscape.

UK Rental and Housing Market Snapshot, Mid-2025

The UK rental and housing market continues to paint a nuanced picture in mid-2025, with the latest figures from the Private Rental Prices Index (PIPR) highlighting key trends.

The average private rent surged to £1,344, reflecting a 6.7% rise, although this marks a slight deceleration from May’s growth rate.

Meanwhile, the housing market reveals an upward trajectory with average house prices reaching £269,000, showcasing a more pronounced 3.9% growth.

This period of evolving dynamics underscores the interplay between rental and housing price movements across the nation.

As the market adjusts, the nuanced shift in rent increments combined with accelerating house-price growth presents a compelling scenario for market observers and stakeholders.

Moreover, specifics such as England’s rental figures hitting £1,399 and a notable rise in Welsh rents to £804 serve as critical indicators for regional disparities.

These data insights emphasize the ongoing transformation within the UK property market landscape.

Nation-Level Private Rents in Detail

The current landscape of private rental prices across the UK reflects significant regional variations, as evidenced by the average rents in England, Wales, Scotland, and Northern Ireland.

In England, private rents have reached an average of £1,399, showcasing a 6.7% increase, while Wales reports a higher growth of 8.2%, with average rents at £804. Meanwhile, Scotland’s rental average stands at £999 with a 4.4% increase, and Northern Ireland’s rents have climbed to £852, marking a 7.6% rise as of April 2025, highlighting the differing inflation rates across these nations.

Inflation Extremes within English Regions

The North East region experienced 9.7% in the North East annual rent inflation, making it the highest in England.

This dramatic increase could significantly impact tenants, increasing the financial strain on individuals and families.

Conversely, Yorkshire and Humber recorded a much lower inflation rate of 3.5%, providing a relatively stable environment for renters and landlords.

While this could potentially slow landlord income growth, it may enhance tenant retention and satisfaction.

The regional disparity highlights how location drives rental market dynamics, influencing housing policies and financial strategies across different areas.

For more detailed insights, refer to the ONS report.

Key Insights

- Highest inflation: 9.7% in the North East

- Lowest inflation: 3.5% in Yorkshire and Humber

- Impact: Varies greatly between regions, affecting tenants’ and landlords’ financial decisions

Shifts in UK House Prices and Regional Contrasts

The UK housing market in 2025 experienced a notable overall increase in property prices by 3.9%, yet regionally, the picture painted varied colors of growth and inflation.

England, boasting a substantial average house price of £290,000, showed a relatively moderate increase of 3.4%.

Conversely, Scotland experienced a more aggressive rise, with prices climbing by 6.4% to reach £192,000.

Adding to the regional contrasts, Wales saw a significant inflation of 5.1%, positioning its average house price at £210,000.

However, the highest spike in property inflation was recorded in the North East at 6.3%, marking it as a hotspot of price escalation.

Meanwhile, the South West emerged as a zone of relative stability with the lowest inflation rate of 1.9%, emphasizing the regional disparities in the booming housing market.

Consequently, these variations highlight the complexity and dynamics within the UK’s property landscape.

How Location and Property Size Shape Rents

The contrasting rental landscapes of London and the North East reveal striking differences, with London dominating as the most expensive region.

The average rental cost there reaches £2,252, which significantly overshadows the North East, where prices linger around £734.

This disparity underscores London’s status as an economic hub, driving up demand and cost for its sought-after locations.

In comparison, the North East offers a more affordable alternative, appealing to those seeking economical housing solutions without the premium attached to metropolitan areas.

As data suggests, London rent surges remain pronounced, contrasting with the milder rises in other UK regions.

In terms of property sizes, the rental prices also reflect specific market dynamics.

Detached homes in the UK stand at approximately £1,533 on average, while larger properties with four or more bedrooms command a premium of £2,007.

Meanwhile, those opting for smaller living spaces may find themselves paying about £1,318 for flats and £1,091 for one-bedroom units.

These figures highlight the increasing desirability for space and privacy in larger homes, although flats and one-bedroom residences remain accessible options for singles or couples.

Such insights into property size and rental price correlations further emphasize the varied housing landscape, catering to diverse preferences and financial capabilities.

Explore the detailed rental pricing analysis on Cluttons property market update for an in-depth understanding of these trends.

Private Rental prices continue to evolve, reflecting broader economic trends.

The disparities across regions and property types underscore the complexities of the rental market, providing valuable insights for all stakeholders.

0 Comments